What factors influence pricing in the LP-led secondaries market?

Ahead of SuperReturn Secondaries Europe, Ethan Levine, Managing Director, Head of Secondaries, Co-Head of Real Assets and Sustainability, CF Private Equity, shares his insight. In private equity limited partners (LP)-led secondaries, one of the most common questions is, “What does pricing look like?” to which a typical response might be, “It depends.” That response, although unhelpful, provides insight into why the secondary market is so dynamic, inefficient, and growing exponentially in interest. The reality is that the market encompasses everything from high-quality, undervalued LP-led buyout secondaries, which trade at a premium, to lower-quality, overvalued interests that could exhibit steep discounts of 70% or more [1]. As one can see, “it depends.”

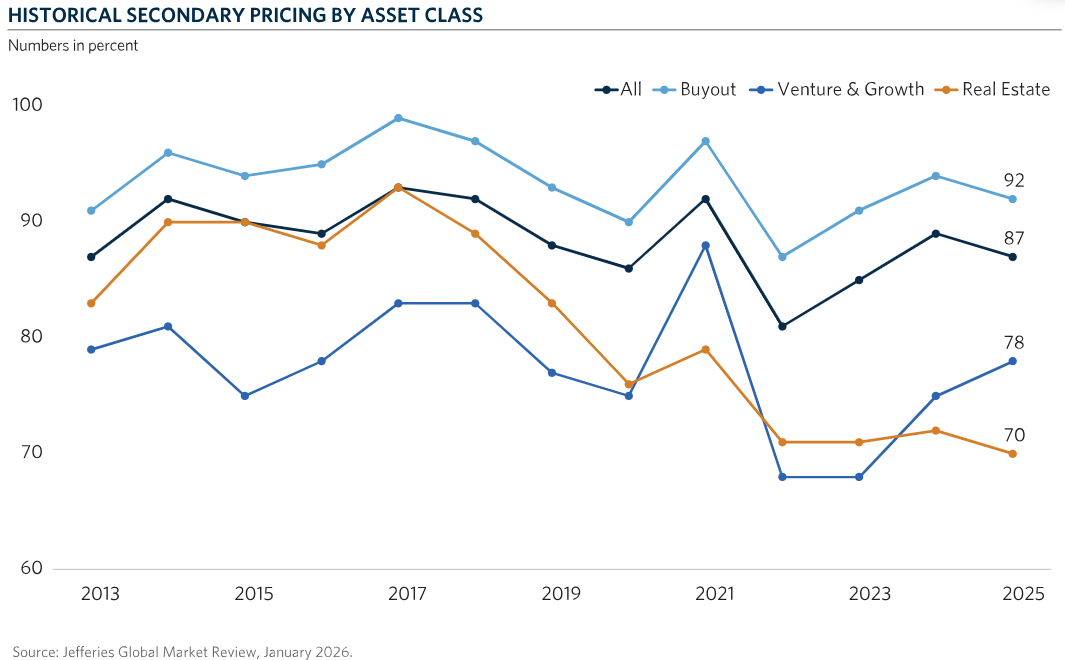

When analysing pricing at an aggregate market level, it’s helpful to understand how private asset classes price relative to one another. Typically, buyout LP interests will price highest and have held steady with discounts normally in the mid-single digits. Credit secondaries have also moved into that realm as well. Conversely, venture and growth LP interests tend to exhibit more volatility and often price at greater discounts. Other areas, like real assets, see a range of pricing, with infrastructure secondaries typically commanding higher prices, and energy and real estate pricing at steeper discounts. Overall, while the broader market has grown, average pricing has tended to hold relatively steady around the high 80s/low 90s, as a percentage of NAV, for all secondaries in aggregate [2].

Looking at average pricing across asset classes helps contextualise relative pricing, but it is usually unhelpful when buyers are underwriting and analysing specific deals and preparing bids. Several key factors are critical when considering what amount a buyer might bid and how a seller should consider what will drive expected pricing on an interest.

Quality matters!

One of the most important determinants of price is the quality of the underlying asset(s). Not surprisingly, higher-quality assets are priced higher than lower-quality assets. That quality can be interpreted based on the underlying operating metrics of a portfolio’s companies as well as on the credibility of the financial sponsor or General Partner (“GP”). Certain sponsors’ LP interests may be priced higher than others for idiosyncratic reasons, such as differences in valuation methodology. Yet, for those buyers who conduct a bottom-up analysis, the health and growth prospects of the underlying companies are of paramount importance.

Valuations

The value of underlying companies can differ dramatically from sponsor to sponsor. In fact, the same company held by two different sponsors, utilising the same operating metrics, could lead to two completely different valuations. For example, in venture capital, some sponsors hold companies at the most recent round of financing, while other sponsors may have a methodology that always holds companies at a significant discount to the most recent financing round. Understanding those methodologies and mapping how a company may be valued elsewhere can be critical to a buyer’s ability to price an asset. Methodology aside, certain GPs will have a more aggressive approach to calculating enterprise value, using higher exit multiples. For example, two sponsors may own the same company, but one sponsor might use a 15x EBITDA multiple while the other sponsor may use a 12x EBITDA multiple. A buyer’s ability to synthesise appropriate multiples, recognise and account for the nuances in valuation approach from sponsor to sponsor, and accurately project how a company might actually exit, will be important in determining how much that buyer is willing to pay for the interest in those companies.

Remaining Duration

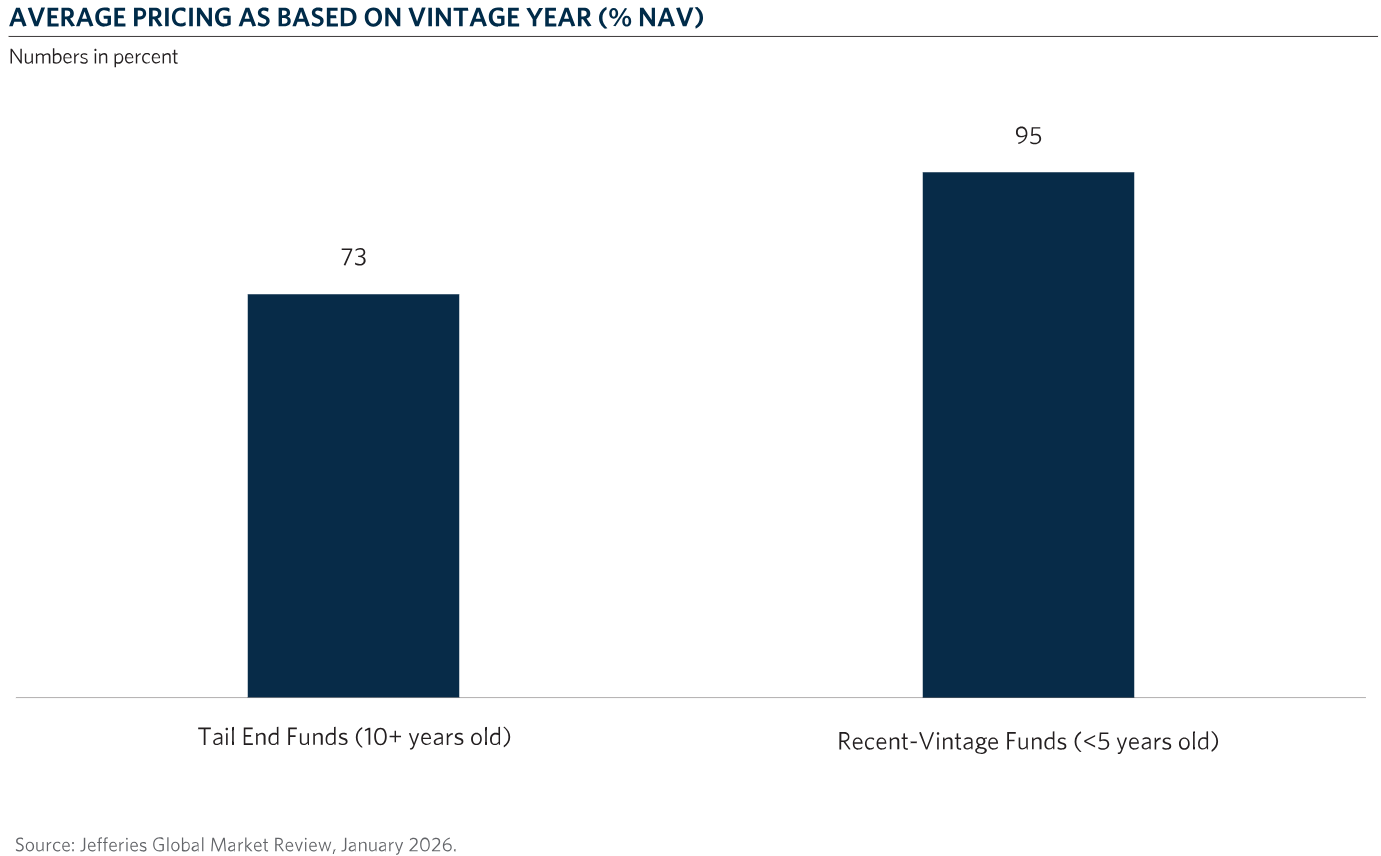

When a buyer considers pricing a portfolio, they will typically project what kind of asset appreciation is possible over the remaining holding period of the underlying GP. If it’s a more recent vintage, the underlying GP could have significantly more time to generate that value uplift, and a buyer might consider that opportunity when factoring what price is appropriate for the mandate’s potential return. If the GP’s portfolio is in the “tail-end” of its life cycle and is in the process of being wound down, the opportunity to generate further value uplift is likely more limited. In fact, the downside risk of underlying assets unable to be competitively sold is far greater. Unsurprisingly, on average, younger portfolios tend to price higher than older portfolios [3]. While vintage years are helpful to directionally guide pricing, the emergence of continuation vehicles (“CVs”) has brought with it another factor to be considered in a buyer’s underwriting. Through CVs, sponsors can now opt for accelerated liquidity as compared to a traditional exit, while potentially reducing the upside potential associated with an extended hold. As such, the ability to balance recognising the motivations and historical tendencies of sponsors and conduct a true bottom-up analysis is critical to understanding the quality and the exit potential of the underlying assets [3].

Transaction size

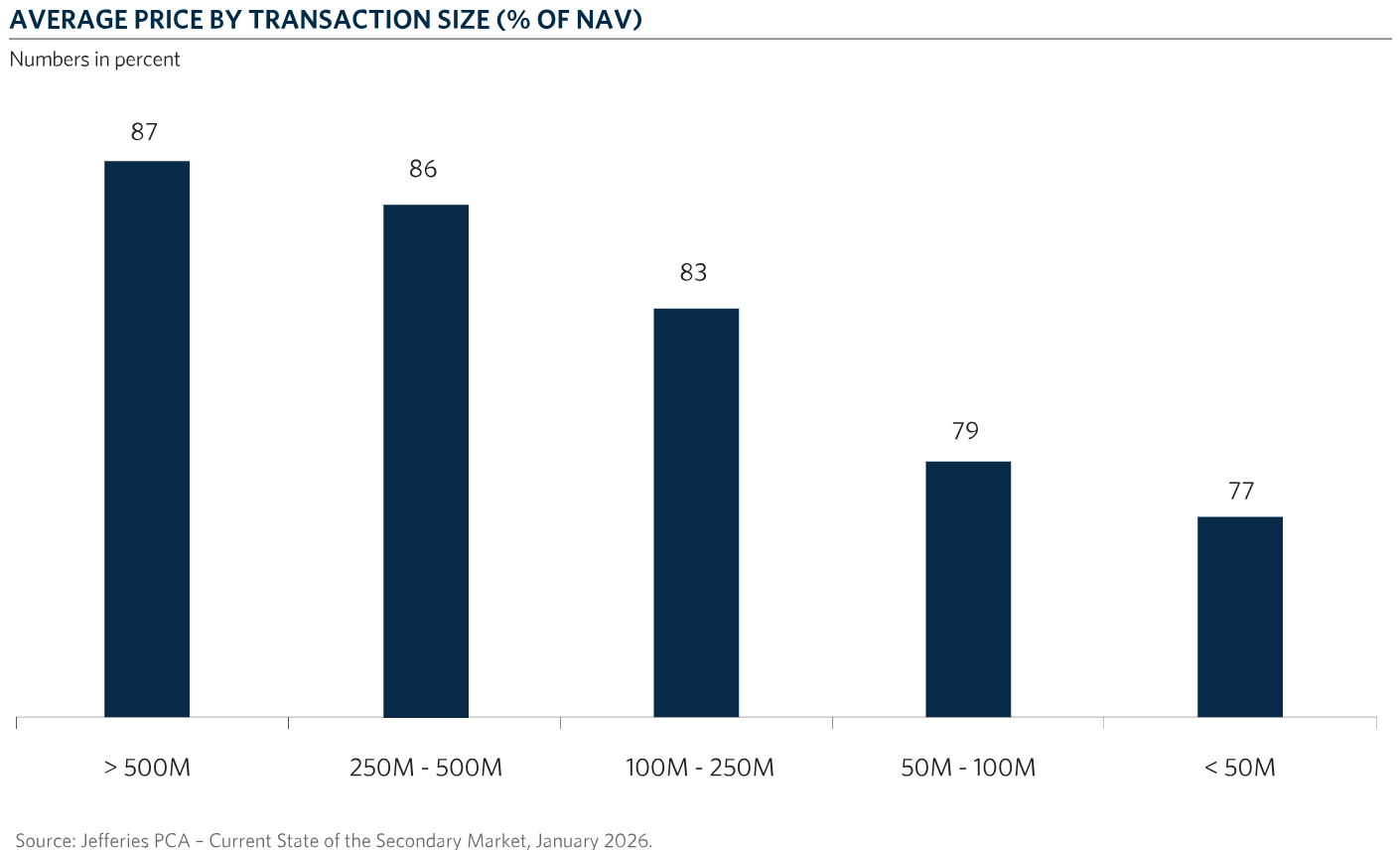

As the secondary market has matured, many buyers have continuously moved up-market. While there is an increasing number of large LP-led deals coming from sellers, this growth may not keep pace with the number of large LP-led buyers clamouring for these opportunities. Larger deals typically utilise an advisor, so all the capable buyers can evaluate them. As the number of buyers looking for larger deals increases and the pressure to put capital to work continues, the pricing tension around these larger deals will remain competitive. Therefore, one sees much stronger pricing with larger transactions. Conversely, smaller transactions are brought forth by a wider variety of brokers (both large and small) and tend to be much less efficient. While there are always new entrants into the market, many of the previously consistent “smaller transaction” buyers have moved up-market, abdicating the smaller end. As such, processes tend to be less competitive, and pricing tends to be softer. This is clearly evidenced by historical average pricing data from Jefferies, which highlights the deeper discount that exists as the size of a transaction decreases [5].

As such, the size of the transaction can be an important variable in the competitive nature of a process and affect the pricing tension that may or may not occur as a result.

Restrictive transfers

When an LP interest is sold, three parties need to agree on the transfer: the buyer, the seller, and the GP. While some GPs are indifferent as to which buyers are eligible to take ownership of the interest, there are many that use discretion as to whom they might prefer and allow into their fund. Some GPs do not want to expand their investor lists and will only make existing investors eligible. Or perhaps they see the potential to build a new strategic relationship and allow those they deem as possible candidates to start such a relationship. Regardless, the more restrictive a manager is on the list of allowable buyers, the less competitive a process might be, and the more dislocation one might find with pricing. Buyers who develop more allowances than restrictions can gain better access to attractive processes as well as pricing advantages.

Advisor relationships

While many proprietary transactions are completed in the secondaries market, about 75% of the market is intermediated by advisors, as per Jefferies [6]. Given that this sub-segment is such a significant part of the market, almost all active buyers of secondaries seek to develop relationships with the advisor community. While such relationships are critical to driving deal sourcing volume, it can also be very helpful in accessing processes that may be more limited due to size or timing dynamics. Advisors who understand a buyer’s preference and credibility can lead to access to less competitive processes, which can then influence pricing relative to more broadly marketed processes.

Cost of capital

While all buyers are focused on optimising returns in the market, different buyers may have different mandates that they are aiming to fulfil. These mandates may lead to different target returns due to differences in their cost of capital. Different costs of capital could be attributed to a variety of reasons, ranging from specialised target asset classes, underlying use of leverage, or the necessity to deploy capital. For example, an infrastructure-focused secondary buyer would likely have a lower cost of capital as compared to a venture capital buyer. Therefore, infrastructure secondaries target returns may be lower and lead to lower discounts relative to NAV as compared to dedicated venture capital buyers. Alternatively, some buyers are willing to lever up purchases of assets and are therefore more comfortable underwriting to lower unlevered returns to compete with those buyers that tend to avoid leverage in transactions [7].

Furthermore, larger transactions present buyers with increased flexibility to explore transaction-level leverage, likely at more favourable terms, as compared to smaller transactions, given potential lender appetite. In turn, this deal-level leverage can drive pricing upwards at the larger end of the market. Lastly, different buyers have different time horizons for putting capital to work. Many draw-down secondary funds typically target ~2-4 years to invest their capital, not necessitating immediate deployment and offering flexibility. Some secondary buyers, like endowments or pensions, have perpetual duration and therefore have limited pressure to deploy capital in secondaries. Such buyers may use a higher cost of capital as a result.

Conversely, evergreen secondary focused funds (typically ’40 Act Funds), which are perpetually fundraising, are constantly bringing in cash and, in their attempt to avoid holding that cash for too long, they try to put that capital to work as quickly as possible. This may lead such buyers to have a slightly lower cost of capital and allow them to offer higher pricing to deploy funds quickly. A 2024 Evercore report found that buyers who used or who would have used ‘40 Act funds in Evercore processes won ~85% percent of their deals, pricing on average at 500 bps higher than the top competing non-40 Act buyers [8]. While it’s often difficult to determine how each buyer may approach the cost of capital in a particular process, it’s an important variable in determining how a price may ultimately be set.

Conclusion

In a market that’s continuing to evolve, while still exhibiting inefficiency, pricing can vary quite widely. It depends upon the competitiveness of a particular process, driven by factors like restrictive transfers, advisor relationships, and size of the transaction. It could also be driven by factors relating to the underlying assets themselves – quality and underlying valuations. For sellers, a larger transaction with a well-known set of high-quality, accessible buyout managers run by a credible advisor should fetch a very strong price. Alternatively, a smaller portfolio with a set of managers that are highly restrictive in more specialised asset classes could present some attractive pricing opportunities for the right buyer. In this ever-evolving market, a buyer’s ability to target less competitive processes, perhaps a smaller transaction or utilising in-house specialised knowledge or a manager that’s highly restrictive, but is already an existing relationship, can lead to more attractive discounts for the buyer. A buyer’s ability to differentiate will be increasingly important as the market evolves, grows and becomes more efficient. As discussed, pricing will continue to have a wide range of outcomes based on several variables – so a typical price? It depends.

[1] Jefferies Global Market Review, January 2026

[2] Jefferies Global Market Review, January 2026

[3] Jefferies Global Market Review, January 2026

[4] Jefferies Global Market Review, January 2026

[5] Jefferies Global Market Review, January 2026

[6] Jefferies PCA – Current State of the Secondary Market, January 2026

[7] Evercore 2025 Secondary Market Report Highlights

[8] Evercore 2025 Secondary Market Report Highlights